Enjoyed this post?

Be sure to subscribe to the nopAccelerate newsletter and get regular updates about awesome posts just like this one and more!

Ecommerce in 2026 continues to grow strongly.

In 2025, around 2.77 billion people worldwide (33% of the world population) shopped online, driven by convenience, wider product choices, and faster, easier shopping experiences. As digital access expands, online shopping is set to become even more popular in 2026, shaping the way people buy every day.

Shopping is no longer complicated. Modern ecommerce platforms are designed to reduce friction without requiring large teams or long development cycles. Around 84% of tech experts already use AI in development, helping teams move faster and reduce effort.

Today’s ecommerce websites are not built only with features in mind. They are built to create stores people enjoy using, through smart search, easy login and checkout, secure payment integration, and mobile-friendly experiences that improve return on investment.

But when you look closer, something feels different.

Many ecommerce businesses are working harder than ever, yet growth feels slower. Customer acquisition costs are rising. Platforms feel more powerful. Technology feels more complex. Decisions feel riskier.

This often happens because businesses don’t clearly understand what is actually changing in the ecommerce market. Headlines highlight growth, but they rarely explain the pressure underneath.

This is not a coincidence.

Ecommerce has entered a new phase, one where size alone no longer guarantees success. To understand ecommerce in 2026, brands, retailers, and ecommerce teams need to look beyond headlines and understand how the market is changing underneath.

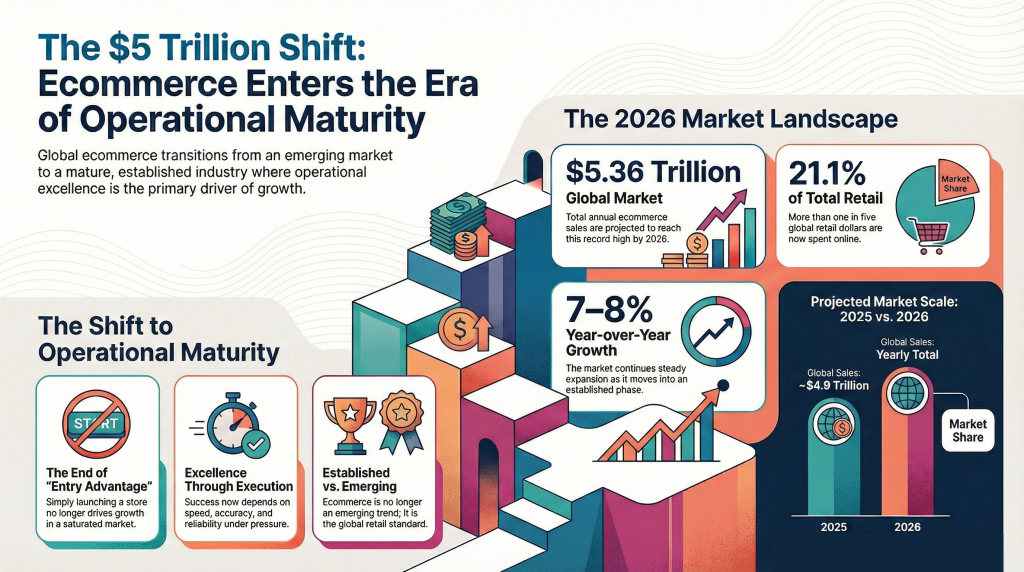

In 2026, global ecommerce sales are projected to reach $5.36 trillion, up from around $4.9 trillion in 2025, representing roughly 7–8% year-over-year growth. Ecommerce now accounts for about 21.1% of total global retail sales, meaning more than one in five retail dollars is spent online.

This confirms one important truth: ecommerce is no longer emerging. It is established.

Crossing the $5 trillion milestone is symbolic, but the real shift is maturity. Almost every serious brand is already online. Customers have endless options. Expectations are high, and errors are costly.

When ecommerce was younger, simply launching an online store could drive growth. In 2026, that advantage is gone.

Ecommerce success is no longer about entering the market, it’s about operating well inside it.

Growth now depends on execution: speed, experience, accuracy, reliability, and systems that scale under pressure.

Global ecommerce growth has slowed compared to the post-pandemic years, but this does not signal decline.

In mature markets, ecommerce growth typically stabilizes between 4% and 8% annually.

This happens when:

For example, the GSA region (Germany, Switzerland, Austria) is growing at around 4.6%, reflecting saturation rather than weakness.

What many businesses misunderstand is this: slower growth means efficiency matters more than expansion.

In 2026, improving conversion rates by even 1–2% can outperform large increases in ad spend. Ecommerce has shifted from a traffic game to a performance and operations game.

One of the most defining ecommerce trends in 2026 is uneven regional growth.

Latin America leads global ecommerce growth at around 12.4%, driven by mobile-first consumers, digital wallets, and improving logistics.

Asia-Pacific remains the largest ecommerce region by volume, supported by strong platform ecosystems and mobile commerce.

Parts of Europe show slower growth due to market maturity and intense competition.

Some countries stand out in particular. The Philippines is growing at roughly 23%, Thailand at around 20%, and Malaysia at about 15.5%.

The message is clear: one global ecommerce setup no longer works everywhere.

Payment methods, mobile behavior, delivery expectations, and trust signals differ widely by region. Businesses that fail to localize often struggle to convert demand into real revenue.

By 2026, 60–73% of global ecommerce traffic comes from mobile devices. In many emerging markets, mobile is not just dominant, it is the primary way people shop.

In mobile-first environments:

Industry studies show that mobile-optimized ecommerce experiences can improve conversion rates by 15–20%, while poor mobile UX directly suppresses growth.

Mobile-first is no longer a design choice. It is the default ecommerce reality.

Online grocery now represents over 10% of total global ecommerce sales, with year-over-year growth above 14%.

This is a major signal.

Grocery is operationally demanding. Customers expect accurate inventory, fast delivery, reliable substitutions, and consistent quality.

When grocery scales online, it shows that ecommerce infrastructure has matured.

It also signals a shift toward frequent, repeat purchases, not just occasional buying.

This places pressure on backend systems such as:

Frontend design alone is no longer enough, operational excellence and technology readiness directly impact revenue.

Marketplaces now account for roughly 87% of global B2C ecommerce spending.

Customers choose marketplaces because they reduce effort:

Marketplaces invest billions in logistics, AI-driven recommendations, and fulfillment networks, shaping customer expectations across the entire ecommerce landscape.

For businesses, the takeaway is not to abandon brand websites, but to use marketplaces strategically. Ignoring marketplaces limits reach. Relying only on them limits control. Balanced strategies perform best in mature ecommerce markets.

These platform dynamics also reflect a deeper shift in how customers discover and evaluate products.

TikTok Shop has emerged as one of the fastest-growing ecommerce platforms, with nearly 60% GMV (Gross Merchandise Value) growth in 2026.

This growth reflects a deeper behavioral shift.

Traditionally, ecommerce started with search, customers knew what they wanted and went looking for it. Today, many purchases begin with discovery. People encounter products while scrolling through videos, watching creators, or consuming content that naturally sparks interest.

In many cases, discovery does not end on the platform. After interest is created, customers often visit a brand’s website to learn more or complete the purchase. This is where strong landing pages and product detail pages matter.

A well-optimized product page helps convert discovery into sales by clearly presenting:

Discovery-led commerce changes the entire buying journey.

Content shapes intent, experience builds trust, and engagement drives conversion. This does not mean every business must sell on TikTok but it does mean ecommerce funnels built only around search and ads are no longer enough.

Customer behavior in 2026 is consistent across most markets.

Shoppers are mobile-first, make faster decisions, and expect instant help during the buying process. Buying online is no longer a slow or linear journey. Customers compare options quickly and expect clarity without friction.

Because of this, shoppers increasingly look for guidance while buying.

This includes:

When customers can quickly find what they are looking for, confidence increases and drop-offs reduce.

This is why modern ecommerce stores focus on assisted shopping experiences. Smart search helps visitors find relevant products faster, even when search terms are incomplete or misspelled. Features such as intelligent filtering, autocomplete suggestions, and real-time results reduce friction and save time.

Many ecommerce platforms also use AI-powered chat support to assist shoppers at key decision moments. These tools help answer common questions, guide product selection, and remove uncertainty. Studies show that shoppers who interact with assisted tools can have up to 4× higher purchase rates compared to those who shop without guidance.

Businesses that provide this level of support consistently see higher engagement and lower cart abandonment.

Not sure if your ecommerce setup matches how customers shop today?

A focused consultation can help identify gaps, priorities, and next steps.

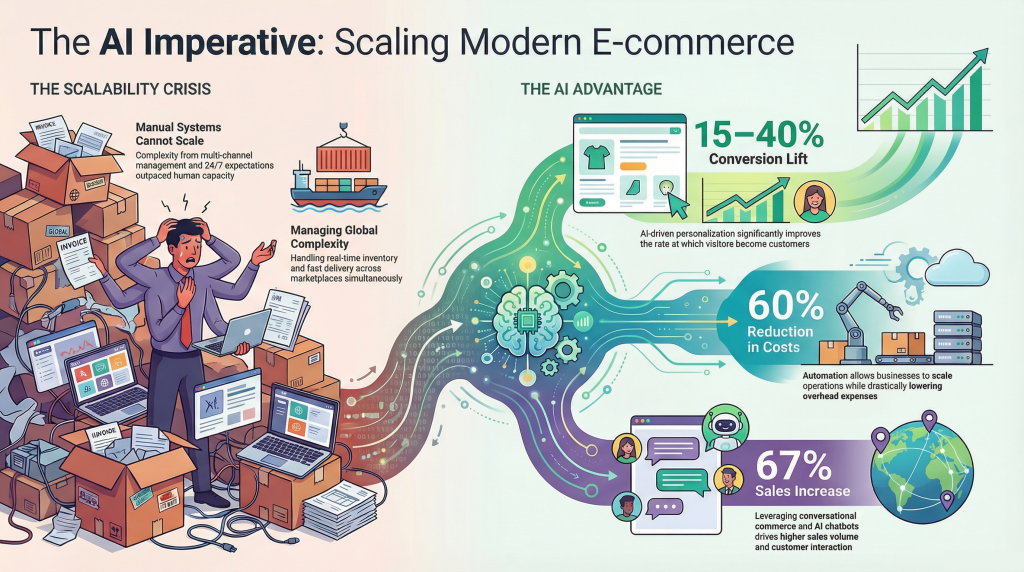

Ecommerce complexity has increased significantly.

Businesses now manage:

Manual systems cannot scale under this pressure.

This is why AI and automation adoption is accelerating.

In ecommerce:

Technology is no longer a nice-to-have. It is how modern ecommerce functions.

Across ecommerce, performance data consistently shows:

Small improvements compound at scale. Optimizing experience often delivers better ROI than increasing marketing spend.

Despite all available insights, common mistakes remain. Many businesses still approach ecommerce mainly as a marketing channel, focusing heavily on traffic and campaigns while overlooking what happens after a customer arrives.

Backend systems are often ignored, even though they directly affect inventory accuracy, order fulfillment, and customer experience. Mobile experiences are underestimated, despite mobile being the primary shopping channel in many markets. At the same time, some businesses over-rely on marketplaces or platforms without a clear long-term strategy, while delaying necessary technology upgrades.

As ecommerce matures, these gaps become more expensive.

The market is not broken. Outdated approaches are.

Ecommerce in 2026 is not about chasing trends. It is about understanding direction.

Successful businesses read market data with context, adapt to regional and platform realities, invest in strong systems, and use technology to solve real problems. Ecommerce today rewards clarity, readiness, and execution.

For teams planning the next phase of their ecommerce platforms or digital commerce strategy, understanding these shifts early can prevent costly mistakes and create long-term advantage.

If you’re planning to build, upgrade, or optimize your ecommerce store for 2026, explore solutions designed for performance, scalability, and long-term growth.

Discuss Your Ecommerce Requirements

Leave A Comment